The NYT reported about the revival of downtown Cincinnati real estate. If you are from out of town, come visit us. If you are from Cincinnati, brag about us. It is a great time to be a Cincinnatian.

Greg Plitt’s Final Run

- Tuesday, 24 February 2015 21:43

Greg Plitt, the “star” of Bravo’s “Work Out” show, was struck and killed by a train last month while allegedly filming a commercial for an energy drink which involved him trying to outrun a train. Sources indicate that his will was not witnessed so TMZ has reported that his father has applied to be the administrator of his $800K estate.

Three quick points:

1. TMZ is not the bastion of legal accuracy so they are incorrect in stating that Plitt’s father will determine which creditors get paid and “how the remaining money gets divvied up.” The intestacy statute of California requires that his parents will share his estate.

2. Any 37 year old should have a will. It is part of being a grown up even if adolescence is prolonged while being a fitness model.

3. While we know that Plitt fatefully disregarded his parents’ advice about not playing on train tracks, it remains uncertain if he disregarded his parents’ admonitions about not running with sharp objects in his hand, playing with matches, and looking both ways before crossing the street.

The Facebook Death Mask

- Thursday, 12 February 2015 22:09

Facebook today announced a change in its policy towards the accounts of deceased users. It will now allow a user to designate a “legacy contact” to manage the account of a deceased user. Previously, Facebook froze the account of a deceased user which left the account in a state of virtual purgatory.

What you need to know:

1. To designate a legacy contact, go to Settings, choose Security, and then Legacy Contact at the bottom of the page.

2. Stupidly, you may not designate a contingent legacy contact so do not choose someone you travel with frequently or who might kill you in a murder-suicide.

3. Legacy contacts may not alter what you have previously posted. If something is embarrassing while alive it will remain embarrassing post mortem.

4. This might all be for nothing anyway. How fun will Facebook be if one cannot post a picture of himself with the most hated man in Kentucky?

The Big Messy (Update – Part Trois)

- Wednesday, 11 February 2015 17:47

The competency of Tom Benson, the owner of the New Orleans Saints and Pelicans, has been challenged by his family in separate court filings in Texas and New Orleans. The Texas judge has decreed that Benson needs assistance managing the assets in a Benson family trust. He appointed two receivers to temporarily replace Benson as trustee. They are not expected to make dramatic changes to his business holdings. The New Orleans judge ordered Benson to undergo a psychiatric examination to determine his competency to make the proposed changes to his succession plan.

Three quick points:

1. This is merely the first round in a likely fifteen round bout. When billions are at stake, the fight will be long and will not likely be resolved during Mr. Benson’s lifetime.

2. I doubt that a competent and uninfluenced man would move $25 million out of his family owned bank to a competitor and tell his car dealership manager that he is the only person in San Antonio he trusts.

3. It is a shame that the court appointed receivers do not have authority to hire a new coordinator for the Saints’s second worst in the league defense.

The Multi-Millionaire Next Door

- Thursday, 05 February 2015 21:31

Ronald Read was a gas station attendant in Vermont who retired after 25 years and then worked as a janitor for J.C. Penney for 17 more years. When he died last year at the age of 92, he left most of his $8 million estate to the local library and hospital. His step son, whose mother died in 1970 after a brief 10 year marriage to Mr. Read, was unaware of his wealth. He was renowned for his frugality, which included not paying for parking, wearing clothes held together by safety pins, and gathering free fire wood for his stove. No one suspected he had any wealth, much less $8 million.

Several quick points:

1. Assets worth more than $5.43 million are subject to federal estate tax, but bequests to charity are not taxable. Mr. Read’s estate will not be subject to federal estate tax.

2. Mr. Read’s estate will not be subject to Vermont estate tax either because Vermont exempts $2.75 million from estate taxation.

3. Kudos to his step-son who continued to visit his step-father for 45 years after his mom died after only 10 years of marriage to Mr. Read.

4. Perhaps we could all accumulate a significant net worth like Mr. Read if we eschewed cell phone and data plans, cable TV packages, and daily Starbucks runs.

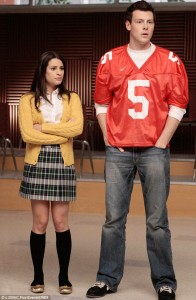

“If I Die Young”

- Tuesday, 03 February 2015 21:49

When Cory Monteith, of “Glee” fame, died in 2013 he did not leave a will. By law, his $810,000 estate is to be distributed to his divorced parents as his closest living relatives. However, because his father did not pay child support to his mother nor see Cory for almost 20 years, he is prohibited from inheriting from his son, which leaves all of the estate to his mother.

Two small points:

1. When one dies without a will, state law dictates who will receive one’s assets. In Ohio, spouses are first in line, followed by children, then parents.

2. It is unusual for young, single people to have wills, but those with $800K estates and a history of substance abuse should definitely have one.

All Dogs Go to Heaven (Update)

- Wednesday, 28 January 2015 09:08

I previously posted about Bela, the German Shepherd, whose owner requested that he be put down, cremated, and have his ashes spread with the owner’s ashes. The owner’s wishes resulted in a social media storm that ended with a Utah animal shelter providing him a home. It turns out that the entire incident was much ado about a month. Bela was diagnosed with cancer over the weekend and put down. His ashes will be buried with his owner’s.

The Big Messy (Part Deux)

- Monday, 26 January 2015 21:02

As I posted the other day, Tom Benson, the owner of the New Orleans Saints and the New Orleans Pelicans, recently changed his estate plan to leave his ownership interests in his teams to his 3rd wife instead of his granddaughter. His granddaughter and other relatives filed suit alleging that he is incompetent and that his changed plan should be barred by the court. Among other allegations, his family claims that when questioned he thought the current U.S. President was Reagan or Truman. He also allegedly lives on “candy, ice cream, sodas, and red wine” and forgot his daughter’s birthday. The lawsuit portrays his wife, Gayle Benson, as a gold digger. She allegedly has removed all photos of his daughter and grandchildren from their house while he has changed all of his previous medical care providers.

Several points:

1. Grounds for contesting a will/trust are absence of mental incapacity (not knowing what one is doing and who one’s heirs would usually be) and undue influence (one person convinces another to leave assets to him/her due to proximity to that person).

2. On the surface, it seems like there is some evidence of both a lack of mental capacity and undue influence in this matter.

3. Don’t we all wish that we could live on “candy, ice cream, sodas,and red wine” and that Ronald Reagan was still president?

4. It would be more appropriate if Gayle Benson were in line to inherit the 49’ers because they are named after real gold diggers.

The Big Messy

- Saturday, 24 January 2015 15:48

Tom Benson, the 87 year old owner of the New Orleans Saints and New Orleans Pelicans, recently announced changes to his succession plan. For years, his granddaughter, Rita LeBlanc, was designated as the future owner of the teams. Benson has since changed his mind and declared that his 3rd wife, Gayle Benson, whom he married ten years ago will run the teams in the future. He also sent a letter to his granddaughter, grandson, and daughter stating that he no longer wishes to see them or communicate with them. He also banned them from attending Saints and Pelicans games because of the way they allegedly treated his new wife (and now future owner of the teams). Of course, the three of them have filed suit seeking to have him declared incompetent.

Several points:

1. Purely from an estate tax viewpoint, leaving the teams to his wife makes sense because as his spouse she will not have to pay estate taxes on the bequests until her death. The bequest to the granddaughter would have been subject to both a 40% estate tax and additional 40% generation skipping tax rate for a combined transfer tax bill of $640 million due to the billion dollar Saints alone. The granddaughter likely would have had to sell the teams to pay this bill.

2. Although the change in succession plan can easily be justified for death tax reasons alone, a note telling family members to never visit him again and forbidding them from attending sporting events is extreme and was guaranteed to provoke a lawsuit from the family members.

3. As a practical matter, all children, not just those of billionaire NFL owners, should bend over backwards to accommodate an elderly parent’s new spouse lest they find themselves as disinherited “po boys” or “po girls.”

Between Friends

- Tuesday, 20 January 2015 22:14

An Andy Warhol painting is in the news. His portrait of Elizabeth Taylor is the subject of litigation between his foundation and his former “bodyguard”, Agusto Bugarin. The painting was expected to bring between $20 million and $30 million at an auction which has since been postponed. The “bodyguard” who stands 5’4″” and weighs 135 pounds, and was likely Warhol’s assistant, claims Warhol gave him the painting for his assistance in renovating a house. The foundation claims that Bugarin was really his bodyguard and has patiently waited for anyone with knowledge of the painting to die before attempting to sell it.

Several, actually five, quick points:

1. Gifts of assets without titles are difficult to prove/disprove. I frequently see this in disputes about jewelry in an estate and whether it was given while mom was alive or taken by one of the daughters after mom died.

2. Warhol died in 1987. 27 years is an incredibly long time for a man of limited financial resources to wait before trying to cash in on something he allegedly stole.

3. Warhol was known for giving away his away. Ask the University of Texas which lost its dispute with Ryan O’Neal over a portrait of Farrah Fawcett.

4. I agree with Warhol’s nephews who claim that Warhol was only joking when he referred to the 5’4″ Filipino Bugarin as his bodyguard. If I had a bodyguard, he would look like an NFL linebacker and only speak mono syllabic English language words. And then only occasionally.

5. I still do not understand the market for Warhol art. I would not pay $20, much less $20 million, for a picture of Elizabeth Taylor in which she resembles a drag queen.

Norway – Land of Fjords, Trolls, and Casey Kasem’s Body

- Wednesday, 07 January 2015 19:39

Following up on a post from last year, Casey Kasem’s widow finally buried his remains several weeks ago in Norway. He supposedly had wished to be buried in LA, but she shipped his unembalmed (and malodorous) remains to Norway because she had ancestors from there.

Three quick points:

1. Unembalmed and rotting remains in a foreign country are difficult to autopsy for purposes of determining elder abuse.

2. The alleged Norwegian ancestral ties of a second wife should be unimportant in determining the burial site of an American of Lebanese descent.

3. Perhaps the widow’s Norwegian ancestors are the trolls important in Norwegian folklore.

Happy New Year

- Thursday, 01 January 2015 16:10

Merry Christmas

- Wednesday, 24 December 2014 17:54

Darlene Love singing “Baby, Please Come Home” for the final time on Letterman. May your Christmas be stand on the piano and belt it merry.

All Dogs Go to Heaven

- Saturday, 20 December 2014 11:04

The will of a Cincinnati area woman is in the national news because it provides that her nine year old German Shepherd mix was to be destroyed and its ashes mixed with hers if a friend did not take the dog or the dog did not go to an Utah shelter for orphaned animals. The friend has declined to care for the aggressive dog who needs muzzling around strangers and the Utah shelter costs $40,000. Animal lovers are horrified about the likely euthanization of the dog and are pillorying the deceased woman in the media.

Several points:

1. Ohio law allows pet trusts. An individual is designated to take care of the animal(s) and someone else manages the funds for the care of the animal. I have drafted quite a few of these in the past 2 years.

2. With the thousands of animals killed daily in shelters, I think the critics’ ire is misdirected when trying to save an elderly Cujo.

3. If the legal proceedings last very long, the dog will reach its life expectancy (10 years for German Shepherds) and die of natural causes. Time is a friend of people and the dog.

The Morning Line – 12/19

- Friday, 19 December 2014 12:00

Paul Daugherty of the Cincinnati Enquirer has once again graciously allowed me to guest write his TML blog.

Is Wisconsin a County in Florida?

- Sunday, 14 December 2014 22:10

A 19 year old Wisconsin man murdered a Milwaukee area businessman in 1971. After being sentenced to life in prison, he escaped prison in 1978, assumed the name of deceased child, established a trouble free life in Florida as a businessman himself, and eventually married in 1996. Only when his wife pestered him for his birth certificate so he could obtain a passport did his life unravel and she filed for divorce. He committed suicide in 2011 five days after being asked to testify under oath about his real name. The family of his murder victim recently filed suit to re-open his estate so they could file a claim against the estate because the estate did not publish a notice of his death in a Wisconsin paper.

Several points:

1. Unless there was a wrongful death lawsuit and judgment, I am not sure what claim the victim’s family has against the estate 40 years after the murder.

2. Ohio requires creditors to file a claim against an estate within six months of the date of death without exception.

3. Ohio does not require publication of any notice for estate creditors.

4. Florida does require publication of notice for creditors but only in the county of the decedent’s residence, not in other counties and presumably not in other states, including Wisconsin.

Stuck Between Worlds?

- Sunday, 07 December 2014 21:40

In the non-story of the year, Patrick Swayze died in 2009 at which time he owned real estate in New Mexico. His widow, Lisa Niemi, recently filed a will to transfer the real estate to their joint trust. Swayze’s family members believe that the will was possibly forged because they did not receive any of his $40 million estate. They contend that the signature does not look like his and that he was admitted to the hospital that day before dying two months later.

Several points:

1. It is rare for someone to include parents and siblings in a will when one has a spouse (and children). It is also possible that the trust provided for his family members.

2. It would not be far fetched for his handwriting to become unrecognizable after suffering from pancreatic cancer for 18 months.

3. Who knew “Ghost” could be real? In a turn of events, even without the help of Oda Mae Brown (Whoopi Goldberg), Swayze’s family is channeling the greed of Sam Wheat’s frenemy, Carl Bruner.

Let The Wild Rumpus Start!

- Wednesday, 03 December 2014 22:25

The NYT reported yesterday on the administration of the the estate of Maurice Sendak, author of the beloved “Where the Wild Things Are”. One of the 3 executors is his caretaker and housekeeper of 30 years (the other 2 are his attorney and the longtime production manager for his publisher). Together they decided to withdraw 10,000 books previously lent to the Rosenbach Museum in Philadelphia. The museum has since sued the estate claiming that original Beatrix Potter books (“The Tale of Peter Rabbit”) and William Blake owned by Sendak are not children’s books and should be given to the museum per his will which left his children’s books to his foundation. The bulk of the estate will create a museum and study center from his house and a foundation to support emerging artists.

Several points:

1. Before the NYT ran corrections to the article, I was going to emphasize how important the selection of an executor is. Sendak realized that by naming 3 executors of his large estate.

2. One of the last things we need in this country is another home turned into museum of an artist/author. We have 15,000 already, most of which are underfunded and rarely visited (only 2,300 visitors to the Flannery O’Connor museum this year so far).

3. The argument of the Rosenbach Museum that books by Beatrix Potter are not children’s books is specious. No adult reads her works when not reading bedtime stories to children.

4. Before the lawyers roar their terrible roars, gnash their terrible teeth, and roll their terrible eyes, they should concede that the works of William Blake are not children’s books (pictures aside) and appeal only to a small segment of adults who are impervious to the misspelling of “Tiger.”

Hat tip to Julie Engebrecht for forwarding the NYT article to me.