Make It Rain

- Thursday, 10 May 2018 18:18

One Down One to Go

- Sunday, 06 May 2018 21:33

Blair (aka Princess) graduated yesterday from Indiana University’s business school. She will start working in Chicago at the end of the month.

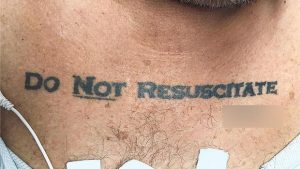

He Would Die 4 U

- Friday, 04 May 2018 09:03

What Is It With Sacramento?

- Friday, 04 May 2018 08:58

The Morning Line

- Saturday, 21 April 2018 12:31

I subbed for Paul Daugherty’s TML blog in the Cincinnati Enquirer again yesterday. I discussed the Reds new manager, the FC Cincinnati MLS bid, and our day in Cuba among other topics.

I hope you enjoy it.

Photo Credit: Sam Greene for Cincinnati Enquirer

License: Photo used in the Enquirer written by me for the Enquirer

#MeToo (#SheWasFirst)

- Tuesday, 10 April 2018 18:28

William Agee was a boy wonder corporate exec in the late 70’s and early 80’s when he helmed Bendix Corporation. Mary Cunningham was a Harvard MBA grad voted most likely to be CEO of a non-cosmetics company. She spurned job offers on Wall Street to work for Bendix as Agee’s personal assistant before being promoted to Vice President. They eventually divorced their spouses and married each other while ignoring rumors that Cunningham had “slept her way to the top.”

After Agee’s several failed business deals reportedly undertaken under Cunningham’s advice, Cunningham became known as the Yoko Ono of finance. They settled in Napa Valley where Cunningham acquired the moniker of “Tomato Lady” for growing special tomatoes.

Six weeks before he died, Agee, reportedly suffering from dementia, changed his will to leave half his assets to his children from whom he had been estranged for 35 years. He also filed for divorce from Cunningham and named his daughter as his health care power of attorney. His last communication with his wife was via Face Time from Seattle. Cunningham is challenging the will although it does not matter because most of his assets were in his trust which was unchanged before his death.

A few points:

1. A will change six weeks before death to benefit children who have been estranged for 35 years will always generate questions of competency..

2. If Agee changed his will prior to his death, he should have also changed his trust if his assets were titled in the name of the trust.

3. Yoko Ono of finance? Tomato Lady? Music fans could only wish that Yoko Ono had grown tomatoes instead of creating unlistenable music and breaking up the Beatles.

Photo Credit: Mary Moritz for the New York Times

License: Fair Use/Education

Back From Spring Break

- Tuesday, 10 April 2018 18:23

Quick Caribbean cruise with Jack and 3 St. Xavier classmates including a day in Cuba. Post soon.

Till I Get to the Bottom and See You Again

- Saturday, 31 March 2018 22:07

In news of no importance, a California court ruled that the body of infamous mass murderer, Charles Manson, should be given to his grandson. The claims of a man claiming to be the son of Manson via an orgy and someone who was Manson’s pen pal were denied. The question of who will inherit Manson’s estate is still to be determined.

A few points:

We Rebelled Against Monarchy for a Reason

- Saturday, 31 March 2018 22:03

Times are slow in the estate planning news area. I have been awaiting the resolution of a court hearing in Hawaii about the estate of their last living “Princess” for the past month. Alas, nothing has been reported.

Abigail Kinoiki Kekaulike Kawananakoa is considered the last living Hawaiian princess. Her great-aunt was the last Queen of Hawaii. Her great-grandfather was a pineapple magnate who left her a fortune. The 91 year old survived a stroke last summer. Her long time attorney was granted control of her $250 million estate. Her long time 64 year old girl friend married her last Fall after initially breaking up with her because she wanted more than the $700K annual allowance she was receiving.

A few points of some pithiness:

1. Planning wise, Abigail should have had a financial power of attorney designating someone to handle her finances if she were incapacitated.

2. She also should have a medical power of attorney allowing someone to assist her with her medical decisions when necessary.

3. Hawaiians revere their royalty no matter how tenuously connected to the throne from 125 years ago.

4. Some (including me) might call a woman who marries an incapacitated wealthy woman 27 years older than her an opportunist rather than a wife.

Photo Credit: AP

License: Fair Use/Eduction

Give It Up or Turnit Loose

- Thursday, 22 February 2018 09:07

James Brown, the Godfather of Soul, died in 2006. His estate is still unsettled due to myriad lawsuits. He had intended to leave $2 million for scholarships for his grandchildren, memorabilia to his children, and the rest to a charity for scholarships for children from SC and Georgia.

James Brown, the Godfather of Soul, died in 2006. His estate is still unsettled due to myriad lawsuits. He had intended to leave $2 million for scholarships for his grandchildren, memorabilia to his children, and the rest to a charity for scholarships for children from SC and Georgia.

Lawsuits have involved whether a woman should have been trustee, whether people should have been removed as trustee, the paternity of a son, and the validity of Brown’s marriage (his wife reportedly was married at the time of their marriage) plus the run of the mill will contest suits. The most recent suit involves whether his wife could sell the rights to his songs.

Two points:

1. There are no good lessons here. If heirs want to fight, they will find reasons to fight and no planning can prevent that.

2. I always preferred the music of Brown’s contemporaries, Otis Redding and Sam Cooke, both who died tragically young. One benefit of dying young is that there is no large estate to fight over nor large family to fight.

Photo Credit: Michael Holahan/Augusta Chronicle, via Associated Press and linked NYT article

License: Fair Use/Education

Return

- Thursday, 22 February 2018 09:04

Back from a father/son ski trip and somewhat back from the February blahs. New post to follow soon.

Back from a father/son ski trip and somewhat back from the February blahs. New post to follow soon.

Not All Tattoos Are Pointless

- Thursday, 22 February 2018 09:02

The Morning Line Again

- Saturday, 27 January 2018 10:23

I subbed for Paul Daugherty’s The Morning Line blog in the Cincinnati Enquirer again yesterday. The only topic was Mike Brown’s management of the Cincinnati Bengals. I will not be receiving Christmas cards from his family anytime soon.

I hope you enjoy it.

Photo Credit: Kareem Elgazzar for the Cincinnati Enquirer

License: I wrote the linked article for the Cincinnati Enquirer 🙂

It’s Not Right But It’s Okay

- Wednesday, 10 January 2018 20:44

The estate of Whitney Houston settled its dispute with the IRS over outstanding estate taxes. The IRS had contended that the valuation of Houston’s back catalog and image and likeness was undervalued by $22 million resulting in $11 million of additional taxes. The settlement was for $2 million. Oddly, or perhaps not given the state of journalism in 2018, the focus of most articles was on the value of her image and likeness but the IRS and the estate differed on that valuation by only $200K.

The estate of Whitney Houston settled its dispute with the IRS over outstanding estate taxes. The IRS had contended that the valuation of Houston’s back catalog and image and likeness was undervalued by $22 million resulting in $11 million of additional taxes. The settlement was for $2 million. Oddly, or perhaps not given the state of journalism in 2018, the focus of most articles was on the value of her image and likeness but the IRS and the estate differed on that valuation by only $200K.

A few small points:

1. Since the death of Michael Jackson, the IRS has been taxing the image and likeness of dead celebrities with the value based on expected licensing revenues in the future.

2. Cool fact – Robin Williams said that his likeness cannot be used for 40 years after his death rendering its value worthless.

3. In the age of streaming music, the longer the estate held out the less valuable the back catalog of albums became.

4. This was purely a principled, but unemotional, victory for the estate. Houston’s daughter died nearly 3 years ago and Houston was divorced. Any estate tax savings will benefit her mother and her brothers.

Not About the Sport Coats

- Wednesday, 10 January 2018 07:40

Craig Sager was a beloved basketball reporter who died last year from cancer. He was known for his colorful sport coats and bantering with Gregg Popovich, coach of the Spurs. He was divorced and re-married at the time of his death with children from both wives. His will is being probated in Georgia. It reportedly left everything to his second wife, Stacy.

Craig Sager was a beloved basketball reporter who died last year from cancer. He was known for his colorful sport coats and bantering with Gregg Popovich, coach of the Spurs. He was divorced and re-married at the time of his death with children from both wives. His will is being probated in Georgia. It reportedly left everything to his second wife, Stacy.

His son from his first marriage tweeted yesterday that he was being summoned to court by a sheriff to prevent him from contesting the will even though he was not interested in contesting in the first place. His sister, Kacy, defended her brother while also flaming her step-mother and tweeted a list of grievances. Seeing a moment in the sun, the former girlfriend of the son felt compelled to jump into the fray and call the step-mother a POS in typical coarse social media parlance.

Several points:

1. Georgia is similar to Ohio in that when a will is admitted to probate all of the heirs at law (spouse and children) plus all of the will beneficiaries are required to receive notice of the probate proceedings via certified mail.

2. The son from the first marriage and his sisters were simply receiving the legally required notice.

3. Given the lapse between the date of death of Sager’s death and the date of this process, it is likely that most of his assets were in a trust and that a small account was titled only in his name and hence subject to the probate process.

4. Sager might have excluded his children from his first marriage due to their hostility to his second wife and/or their over-reaction to legal events.

5. Hostility to second wives can be avoided if they are age appropriate and their names do not rhyme with that of one’s daughters.

TML Again

- Wednesday, 20 December 2017 14:54

I guest wrote Paul Daugherty’s TML blog on Friday. I covered the best and worst in Cincinnati sports this year, plus some other topics such as possible successors to Marvin Lewis. I hope you enjoy it.

Ocean’s 14

- Wednesday, 13 December 2017 20:37

Rande Gerber, husband of Cindy Crawford, recently told a TV program that George Clooney gave $1 million to 14 of his long time buddies four years ago. Clooney invited his friends to his house for dinner and presented each of them with an expensive leather suitcase.

When the friends opened them, each found $1 million in $20 bills. Clooney told them he had appreciated their friendship and wanted to help those who were struggling. He also said he had paid their taxes on the gift. Gerber did not want to take the money, but Clooney said no one would get their money if Gerber did not take his.

Several points:

1. This generosity resulted in a gift tax of $3.0 million to Clooney. In 2013, gifts to an individual in excess of $14K and beyond the $5.25 million exemption were taxed at 35%.

2. Despite his statement about paying their taxes, Clooney was obligated to pay the gift tax – the donor is always liable for the gift tax owed.

3. Having won the lottery twice – marrying Cindy Crawford and selling his Casamigos Tequila brand for $700 million – Gerber donated his million to charity to keep his good karma flowing.

Photo Credit: Reuters

License: Fair Use/Education

I Don’t Think I Love You

- Wednesday, 13 December 2017 20:34

Limping to the end of the year while looking for celebrity news. Finally found some with respect to former teen heartthrob, David Cassidy, of Partridge Family fame. The will of the thrice divorced entertainer leaves his entire $150K estate to his son, Beau, from his third marriage. Cassidy specifically excluded his daughter from a previous relationship, actress Katie Cassidy, from the will. Meanwhile, a law firm which represented him has sued the estate for $100K of unpaid fees.

Several points:

1. Cassidy is free to leave his assets to whom he wishes – he is not obligated to leave them to his out of wedlock daughter.

2. The law firm should be paid from the estate before beneficiaries receive any distributions.

3. $150K estate after 50 years in show business? Divorce and drugs are expensive habits.

Photo Credit: Facebook.com/Respect for Katie Cassidy

License: Fair Use/Education

Happy Thanksgiving

- Tuesday, 28 November 2017 21:13

Happy Thanksgiving from our family to yours.

(Apologies for tardiness – I posted this on Facebook on Thanksgiving but have been too slammed at work to post it here).

From Marco Island.

From Marco Island.