The Walt Disney Company is reportedly set to receive $50 million due to the death of Carrier Fisher. Disney owns Star Wars and had taken out an insurance policy on Fisher in the event she was unable to complete the new three film trilogy. Filming had wrapped on Episode VIII but Episode IX, due in 2019, will need a script re-write.

Several minor points:

1. The insurance on Fisher is a form of “key man” insurance which many companies purchase on the lives of their valuable employees to protect the company in the event of the death of the employee.

2. $50 million seems excessive given the limited role that Fisher played in The Force Awakens.

3. The insurance carrier is likely wishing that it had rather insured the life of Harrison Ford, whose Han Solo died during Episode VII, and who will not appear in any more episodes.

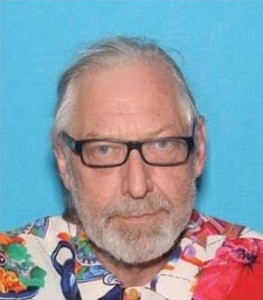

Photo Copyright: REX/Walt Disney/Shutterstock/Robot

License: Fair Use/Educational Purposes

From my family to yours. We are thankful for your friendship.

From my family to yours. We are thankful for your friendship. I subbed for Paul Daugherty’s The Morning Line Blog again on Friday.

I subbed for Paul Daugherty’s The Morning Line Blog again on Friday.