Stepping away from celebrities for a minute and focusing on estate laws, yesterday the IRS issued proposed regulations to minimize valuation discounts in estate planning. In a nutshell, the regulations prohibit taxpayers from dividing property between family members and then claiming their proportionate shares are not worth the exact proportion because that small proportion does not have control of the property. Wonky? Yes.

Two Halves Do Not Make a Whole?

- Wednesday, 03 August 2016 21:38

Simon Says This Is Not a Gift

- Sunday, 31 July 2016 17:25

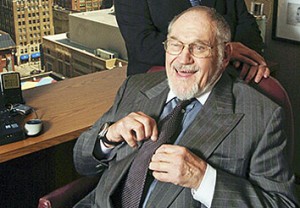

Mel Simon owned the Indiana Pacers with his brother, Herb, for 16 years. After the Malice in the Palace in 2004, the Pacers started losing money and Simon became disenchanted with his ownership of the team. He sold his interest to his brother in a very quiet deal that was two years in the making. The terms included being released from various personal guarantees. Simon died shortly thereafter of pancreatic cancer. The IRS determined that the deal was so favorable to his brother that his estate owes a gift tax of $21 million. His widow has sued the IRS for a refund of the gift tax paid.

Mel Simon owned the Indiana Pacers with his brother, Herb, for 16 years. After the Malice in the Palace in 2004, the Pacers started losing money and Simon became disenchanted with his ownership of the team. He sold his interest to his brother in a very quiet deal that was two years in the making. The terms included being released from various personal guarantees. Simon died shortly thereafter of pancreatic cancer. The IRS determined that the deal was so favorable to his brother that his estate owes a gift tax of $21 million. His widow has sued the IRS for a refund of the gift tax paid.

Several quick points:

1. An individual may give away $5.45 million during his life before he has to start paying gift tax.

2. The gift tax rate is 40%.

3. The donor is the person responsible for paying the gift tax.

4. This deal between brothers sounds complicated. It is doubtful that one brother would intentionally give the other $83 million.

5. The widow can afford the tax bill – Simon’s estate was valued at $2 billion because of his pioneering development of shopping malls.

6. Ironic that Simon’s loss of interest in basketball ownership is tied to the Malice in the Palace. Ron Artest – the gift that keeps on giving.

Back At It

- Sunday, 31 July 2016 17:17

Not Friends

- Thursday, 14 July 2016 20:56

Jennifer Aniston’s recently deceased mother allegedly left Aniston out of her will. Even though Aniston reportedly supported her mother in recent years, her mother left her personal belongings and condo to another unidentified relative. Aniston and her mother had been estranged for years and had only somewhat reconciled two weeks before the mother’s death.

Jennifer Aniston’s recently deceased mother allegedly left Aniston out of her will. Even though Aniston reportedly supported her mother in recent years, her mother left her personal belongings and condo to another unidentified relative. Aniston and her mother had been estranged for years and had only somewhat reconciled two weeks before the mother’s death.The Nest

- Monday, 11 July 2016 23:21

Gosh, times are slow in the newsworthy estates and trusts area, except for the conga line of people claiming to be heirs of Prince. Reluctantly resorting to fiction for material, “The Nest” by Cynthia D’Aprix Sweeney is on many best books of summer lists. It has several estate planning lessons which can be gleaned from the following plot facts (all of which are in the first 40 pages so hopefully I not spoiling anything for anyone who wants to read the book).

Gosh, times are slow in the newsworthy estates and trusts area, except for the conga line of people claiming to be heirs of Prince. Reluctantly resorting to fiction for material, “The Nest” by Cynthia D’Aprix Sweeney is on many best books of summer lists. It has several estate planning lessons which can be gleaned from the following plot facts (all of which are in the first 40 pages so hopefully I not spoiling anything for anyone who wants to read the book).

A father created a trust for his four children. The trust was to be distributed when the youngest child reached the age of 40. His wife had the power to invade the trust in the event the children needed the funds earlier. One of the children had a power of attorney from his husband which allowed him to mortgage their vacation property without the husband knowing about the mortgage (trust me, I got the pronouns correct). Another child had a legal predicament which resulted in his mother lending him the entire proceeds of the trust to bail him out and hoping that he would re-pay the amount (called “the nest” by his siblings).

Points to be learned:

1. One should never give a power of attorney to a non-aged spouse unless it is contingent on disability. The potential for abuse is too great otherwise.

2. This trust should have divided into separate shares either at the conception or when the children were in their early 20s. Each child could have then borrowed from his or her share only, if necessary, rather than from the entire trust.

3. The wife/mother of the children should not have had the power to distribute all of the funds without being held to a prudent investor standard.

4. Of course, if there had been good estate planning there would not have been a novel, nor would I have a blog.

Back From California

- Monday, 11 July 2016 23:15

The Morning Line

- Saturday, 02 July 2016 11:02

I subbed for Paul Daugherty on his The Morning Line blog yesterday for the Cincinnati Enquirer. I reviewed the best and worst of the first half year in sports. I hope you enjoy it.

I subbed for Paul Daugherty on his The Morning Line blog yesterday for the Cincinnati Enquirer. I reviewed the best and worst of the first half year in sports. I hope you enjoy it.

Broken Refrigerator

- Monday, 27 June 2016 21:59

Scraping a bit for probate and will related news this week. William “Refrigerator” Perry shot to stardom as the large defensive lineman who sometimes played running back for the awesome 1985 Chicago Bears. He allegedly could dunk a basketball even though he weighed 300 pounds. He now lives in South Carolina under a legal guardianship created by his brother when he was near death 7 years ago. Fridge’s son wants to remove the brother as guardian while a court has stated that the guardianship can be removed if Fridge files the appropriate paperwork. Fridge, meanwhile, spends his days drinking with various friends, walking assisted by a walker, and generally not taking care of his health.

Several points:

1. Any interested party can apply to be the guardian of another with the supporting medical documentation. The son could have applied to serve as guardian in 2009 but did not.

2. Guardians are compensated for their services. Despite the son’s allegations, the $1,250 annual compensation received by the brother is not the reason he continues to serve as guardian of Fridge.

3. A guy who starts drinking first thing in the morning and is unmotivated to file paperwork to remove a guardianship likely still needs the protection of the guardianship.

4. This has bothered me for 30 years. It has always been reported that Fridge could dunk a basketball. How hard would it have been to ask him to do it? It is not as if basketball courts are as scarce in this country as bobsled courses.

Who Is Philthy?

- Tuesday, 21 June 2016 22:03

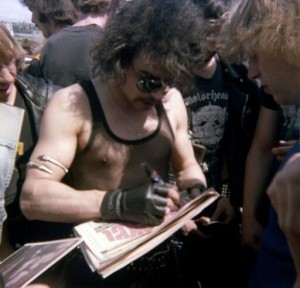

Phil Taylor, also known as Philthy Animal, was the drummer for Motorhead. He died of liver failure last November. Prior to his death, he divorced his wife of 15 years who he had not seen since several weeks after their wedding. He also omitted her from his will. His estate was rumored to be worth $10 million.

Phil Taylor, also known as Philthy Animal, was the drummer for Motorhead. He died of liver failure last November. Prior to his death, he divorced his wife of 15 years who he had not seen since several weeks after their wedding. He also omitted her from his will. His estate was rumored to be worth $10 million.Props to Jetblue Passengers

- Thursday, 16 June 2016 21:16

A woman was on a Jetblue flight to Orlando to attend the funeral of her grandson who was murdered last weekend by the Islamic terrorist. A Jetblue flight attendant whispered to each passenger about signing a sheet of paper to show their support for her. She wound up needing many pieces of paper because people were writing paragraphs of compassion for the grandmother. When the woman left the plane, every single passenger hugged her.

Shake Down the Thunder

- Sunday, 12 June 2016 23:16

Aubrey McLendon was an Oklahoma City businessman who made his fortune in the energy business. He died in a March auto accident the day after he was indicted for allegedly rigging the price of oil and gas leases. He also owned 20% of the Oklahoma City Thunder. Attorneys for one of the lenders to his business have already filed motions in the probate court asking for input into the sale price of his interest in the NBA team. They fear the estate will sell it to his widow for less than the maximum price even though it is not currently for sale. They stated that the primary purpose of the probate court is to protect the interest of creditors.

Aubrey McLendon was an Oklahoma City businessman who made his fortune in the energy business. He died in a March auto accident the day after he was indicted for allegedly rigging the price of oil and gas leases. He also owned 20% of the Oklahoma City Thunder. Attorneys for one of the lenders to his business have already filed motions in the probate court asking for input into the sale price of his interest in the NBA team. They fear the estate will sell it to his widow for less than the maximum price even though it is not currently for sale. They stated that the primary purpose of the probate court is to protect the interest of creditors.Back From Vacation

- Sunday, 12 June 2016 23:13

Unduly Influenced Boss (Sumner Redstone Pt. 5)

- Thursday, 26 May 2016 21:24

Viacom and CBS President, Sumner Redstone, is back in the news this week. He removed Phillipe Dauman and George Abrams, who are directors of Viacom, as Trustees of one of his trusts. They are contesting their removal by alleging he is incompetent. In a huge twist of irony/self-preservation/whatever you want to call it, only six months ago they testified he was competent to remove a girlfriend as his health care proxy.

Viacom and CBS President, Sumner Redstone, is back in the news this week. He removed Phillipe Dauman and George Abrams, who are directors of Viacom, as Trustees of one of his trusts. They are contesting their removal by alleging he is incompetent. In a huge twist of irony/self-preservation/whatever you want to call it, only six months ago they testified he was competent to remove a girlfriend as his health care proxy.

Three brief points:

1. The stakes in the previous battle involved who could make his health care decisions if he could not (while the real plot was whether he could change his will to disinherit his former girlfriend) while these stakes are who gets to control Viacom and CBS after Redstone’s death.

2. I think if Redstone is in a wheelchair, being fed by a feeding tube, and able to communicate only through an aide now, and was in the same condition six months ago, he was likely incompetent at both junctures.

3. Dauman and Abrams have reaped what they have sown. Being close to Redstone is like having an alligator as a pet – it might seem cool, but eventually it (i.e. he) will devour you.

Hillary and Hypocrisy Both Begin With H

- Monday, 23 May 2016 21:55

Hillary Clinton’s recently released financial disclosure statement reveals that she and her husband both created a qualified personal residence trust in 2010 and transferred ownership of their NY home to it. They did not transfer their more expensive Washington DC house to a similar trust.

Several quick educational points:

1. A qualified personal residence trust allows them to transfer the house at a discounted gift tax value based on how long they wish to reside in the house and the current interest rates.

2. For example, if they decided to live in the house for the next 20 years (and not die), they would be able to transfer the entire $1.7 million house to Chelsea while only valuing it at $400K for gift tax purposes.

3. Future appreciation is also excluded from their estate.

4. They would have been wise to transfer the DC property via this technique because that house has doubled in value while the NY property has only increased nominally.

5. While this estate planning technique is available to everyone, I find it hypocritical that a woman campaigning for higher estate taxes and other taxes in the name of the greater good does everything she can to avoid those taxes.

Laughing At Death

- Tuesday, 17 May 2016 20:59

One Disinherited Ex-Girlfriend

- Sunday, 15 May 2016 21:14

The reports of a settlement between Sumner Redstone and Manuela Herzer over her replacement as his health care proxy were premature. There actually was a brief trial over the dispute which ended with the judge dismissing Herzer’s suit to remain as his health care decision maker. The judge relied on a 7 minute deposition of Redstone in which the few intelligible sentences he uttered were “Manuela is a ****ing bitch” (twice) and “I want Manuela out of my life. Yeah.” Of course Herzer’s attorneys have vowed to appeal.

The reports of a settlement between Sumner Redstone and Manuela Herzer over her replacement as his health care proxy were premature. There actually was a brief trial over the dispute which ended with the judge dismissing Herzer’s suit to remain as his health care decision maker. The judge relied on a 7 minute deposition of Redstone in which the few intelligible sentences he uttered were “Manuela is a ****ing bitch” (twice) and “I want Manuela out of my life. Yeah.” Of course Herzer’s attorneys have vowed to appeal.

Several points:

1. This case remains about Redstone’s will which he changed at the same time as his health care power of attorney. Herzer was reportedly to receive $70 million at his death.

2. Herzer, who smartly declined an offer of marriage from Redstone, has reportedly received $75 million in gifts from him while the woman who did become his second wife only received $10 million because she signed a pre-nup.

3. While Redstone, like the recently deceased Prince, believes he will live forever, at least he has planned for his death by having a will and various trusts.

Float Like a Butterfly, Get Stung By a Bee

- Sunday, 08 May 2016 22:00

The ever not so eloquent, Snoop Dogg, was asked this week if he had a will or estate plan. His NSFW response was, “I don’t give a f— when I’m dead. What am I gonna give a f— about? This goin’ on while I’m gone, you know?”

The ever not so eloquent, Snoop Dogg, was asked this week if he had a will or estate plan. His NSFW response was, “I don’t give a f— when I’m dead. What am I gonna give a f— about? This goin’ on while I’m gone, you know?”

And continuing in his non-King’s English, he added, “Hopefully, I’m a butterfly, I come back and fly around and look at all these motherf—–s fighting over my money and s–t, like, ‘Look at all these dumb motherf—–s.’ Ha!”

Only four sentences, but so many points. Minimizing them:

1. Snoop can make life easier for his loved ones if he spends a bit of time deciding who should inherit the wealth accumulated from his questionable talents. He could eliminate any people claiming to be his illegitmate child by naming people in his will.

2. Prince reportedly has had 900 people come forward for DNA testing claiming to be his haIf-siblings while anyone who can establish that he is Prince’s child, will hit the jackpot and inherit all of Prince’s wealth.

3. Raise your hand sheepishly if you think Snoop has fewer illegitmate children than Prince. You would be wrong.

4. I doubt Snoop views his family as loved ones when he refers to them as “dumb motherf—–s.”

5. Maybe it is just me, but if I were reincarnated, unlike Snoop I would prefer to return as something more fierce and substantial than a short lived insect with pretty wings.

TML Guest Blogging

- Friday, 06 May 2016 09:36

Paul Daugherty allowed me to guest write his TML Blog for the Cincinnati Enquirer. I covered today’s sports news plus a few UC sports issues. I hope you enjoy it.

Piece of Britney

- Wednesday, 04 May 2016 21:27

When Britney Spears had her breakdown in 2008 (think shaved head and window smashing), her father and attorney became her conservators. In Ohio, they would be known as guardians. They manage both her physical well being and her finances. As such, they make sure she takes her medicine for her unspecified illness as well as manage her career.

When Britney Spears had her breakdown in 2008 (think shaved head and window smashing), her father and attorney became her conservators. In Ohio, they would be known as guardians. They manage both her physical well being and her finances. As such, they make sure she takes her medicine for her unspecified illness as well as manage her career.