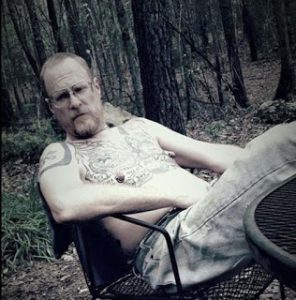

“S-Town” is the critically acclaimed successor podcast to “Serial.” The anti-hero, John B, lives in a Faulkner-esque house on 128 acres in Woodstock, Alabama with his octogenarian mother who suffers from dementia. He is a genius horologist (clock repairman), builder of a “Shining” type maze on his property, hypocrite about tattoos, and so obsessed with climate change and other problems that he makes Thomas Malthus seem optimistic.

John B. was thought to be worth a large amount of money by residents of Woodstock. During the podcast he mentions that he wants to leave $20,000 to his friend, Tyler. He also tells Tyler (spoiler alert) on the night that he commits suicide that Tyler can have his property. Sadly, John B. died without writing a will or without having a plan for someone to take care of his mother. Mystifyingly, John B. claims to have been unbanked which led Tyler and others to search his property for locations where he could have buried gold and cash. He did leave instructions with a friend about what to do and whom to contact after his death.

Several points:

1. If one has to choose between leaving a will or instructions about what to do after death, one should choose a will.

2. Embrace the power of “AND”. One should be able to leave a will AND instructions about what to do after death.

3. Without a will, John B’s assets if found legally will go to his mother. Without a health care power of attorney, the care of his mother will go to a relative willing to serve as guardian.

4. Being unbanked might make sense for someone of little financial means. For someone who might have made hundreds of thousands dollars annually and is prone to suicidal threats, being unbanked can only lead to one’s property looking like a scene from “Holes.”