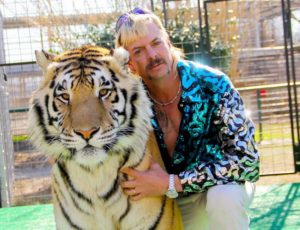

“Tiger King” is the exploitative Netflix series that even has the DC press corps asking questions about pardons to President Trump. One of the plot lines is the disappearance of Don Lewis and Joe Exotic’s (and Lewis’ daughters’) allegations that Lewis’ wife, Carole Baskin, killed Lewis and fed him to their lions in 1997.

For those not watching the show, Lewis and his much younger wife operated a large cat sanctuary in Florida. Lewis had a limited education (he filed legal docs with “enough” spelled “enouf”) but had made decent money in scrap metals and better money buying real estate subject to unpaid property taxes.

Lewis disappeared in 1997 without a trace. He had purchased a plane ticket to Costa Rica where he owned property and where he allegedly went to have daily sex while his wife was menstruating (gosh, I know this is tawdry, but she blogged about it). His car was found at a small airport 40 miles from his home. His passport was not swiped in Costa Rica nor the U.S.

Lewis left a power of attorney prepared by his wife in late 1996 that said that she could control his finances in the event of his disability or “disappearance.” Although I have not seen his will, it allegedly referred to “his kidnapping or disappearance.” His wife reportedly inherited $4 million and Lewis’ daughters from his first marriage received $1 million from a trust when he was declared dead in 2002. His daughters allege that the will and powers of attorney were forged. They also have accused Carole of killing him. Due to the publicity generated by the series, the sheriff in Hillsborough County has re-opened the investigation into the disappearance of Lewis.

So many thoughts, but let’s keep them to a minimum which is difficult to do over 7 episodes and countless blog posts and Internet stories:

1. The power of attorney is available on-line. It is professionally prepared with no typos with full justification of the margins even though prepared by Carole. It is possible she downloaded the template from Nolo, but highly unlikely that it included “disappearance” relating to its effectiveness.

2. In 33 years of preparing powers of attorney, I have never conditioned their effectiveness on “disappearance.”

3. A will that refers to “kidnapping or disappearance” does not make sense because wills only become effective upon death.

4. The power of attorney and will allegedly had the same witnesses, one of whom later said she did not actually witness the signing.

5. Although Lewis’ daughters alleged “forgery’, they likely meant that their father was unaware of the specifics of the documents he signed.

6. Lewis’ assistant, Ann McQueen, has alleged that she had the original power of attorney and will in her possession but Carole removed them from her office after his disappearance. When I suspect that documents might be contentious if they disappear, I offer to retain the originals.

7. Wow, there is a bunch of smoke here, including the refusal of Carole to take a polygraph test and allow an inspection of her property, but I have no snarky observation. A slander suit from these litigious folks is not worth it.

Photo Credit: Netflix

License: Fair Use/Education