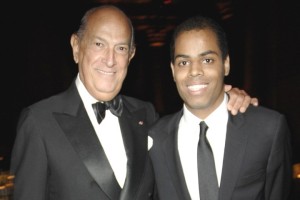

On Father’s Day, let’s briefly recap the will of fashion designer, Oscar De La Renta, who died last Fall. It was recently reported that he snubbed his adopted son, Moises, in his will because he was upset that his then 20 year old son had tried to compete with him in the fashion design business by producing five or six pieces under his own name 10 years ago. De La Renta left $18 million of real estate to his second wife of 25 years, then put the rest in trust for her, her children, and his son. That amount likely was $5.34 million.

Several points:

1. Funds left to his wife will not be subject to estate taxation until her death while leaving anything in excess of $5.34 million in trust or to his son will be taxed at a rate of 40%.

2. Context is everything. I doubt De La Renta was so insecure as to have been threatened or annoyed by his son’s attempt to follow him into the business. Reporting that the son was disinherited for that reason makes for a nice narrative, albeit false.

3. After 25 years of marriage, it is not unusual to leave a significant portion of an estate to a spouse, even if there are children from a prior marriage. Leaving a football team worth $1 billion to a third wife of 10 years is questionable, though, Tom Benson.