Stepping away from celebrities for a minute and focusing on estate laws, yesterday the IRS issued proposed regulations to minimize valuation discounts in estate planning. In a nutshell, the regulations prohibit taxpayers from dividing property between family members and then claiming their proportionate shares are not worth the exact proportion because that small proportion does not have control of the property. Wonky? Yes.

Two Halves Do Not Make a Whole?

- Wednesday, 03 August 2016 21:38

- Written by Jay Brinker

- 0 Comments

Simon Says This Is Not a Gift

- Sunday, 31 July 2016 17:25

- Written by Jay Brinker

- 0 Comments

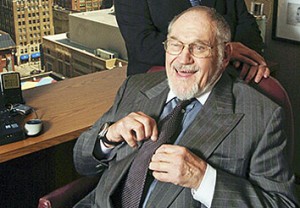

Mel Simon owned the Indiana Pacers with his brother, Herb, for 16 years. After the Malice in the Palace in 2004, the Pacers started losing money and Simon became disenchanted with his ownership of the team. He sold his interest to his brother in a very quiet deal that was two years in the making. The terms included being released from various personal guarantees. Simon died shortly thereafter of pancreatic cancer. The IRS determined that the deal was so favorable to his brother that his estate owes a gift tax of $21 million. His widow has sued the IRS for a refund of the gift tax paid.

Mel Simon owned the Indiana Pacers with his brother, Herb, for 16 years. After the Malice in the Palace in 2004, the Pacers started losing money and Simon became disenchanted with his ownership of the team. He sold his interest to his brother in a very quiet deal that was two years in the making. The terms included being released from various personal guarantees. Simon died shortly thereafter of pancreatic cancer. The IRS determined that the deal was so favorable to his brother that his estate owes a gift tax of $21 million. His widow has sued the IRS for a refund of the gift tax paid.

Several quick points:

1. An individual may give away $5.45 million during his life before he has to start paying gift tax.

2. The gift tax rate is 40%.

3. The donor is the person responsible for paying the gift tax.

4. This deal between brothers sounds complicated. It is doubtful that one brother would intentionally give the other $83 million.

5. The widow can afford the tax bill – Simon’s estate was valued at $2 billion because of his pioneering development of shopping malls.

6. Ironic that Simon’s loss of interest in basketball ownership is tied to the Malice in the Palace. Ron Artest – the gift that keeps on giving.

Back At It

- Sunday, 31 July 2016 17:17

- Written by Jay Brinker

- 0 Comments

Not Friends

- Thursday, 14 July 2016 20:56

- Written by Jay Brinker

- 0 Comments

Jennifer Aniston’s recently deceased mother allegedly left Aniston out of her will. Even though Aniston reportedly supported her mother in recent years, her mother left her personal belongings and condo to another unidentified relative. Aniston and her mother had been estranged for years and had only somewhat reconciled two weeks before the mother’s death.

Jennifer Aniston’s recently deceased mother allegedly left Aniston out of her will. Even though Aniston reportedly supported her mother in recent years, her mother left her personal belongings and condo to another unidentified relative. Aniston and her mother had been estranged for years and had only somewhat reconciled two weeks before the mother’s death.