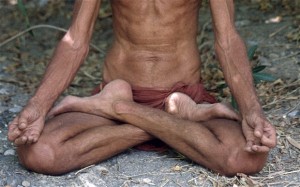

One of India’s wealthiest Hindu spiritual leaders died in January from a presumed heart attack. His followers placed his body in a guarded, commercial freezer on their Ashram and maintain that he has drifted to a deeper form of meditation as a pathway to self realization. His family has asked an Indian court to order the release of the body for cremation. The family maintains that the followers are claiming he is alive so they can retain control of his $170 million estate.

Two quick points:

1. $170 million is nice coin for a religious leader and even more so in a country with per capita income of $1,200.

2. The guru’s disciples might have solved the riddle of eternal life – simply freeze all dead bodies while waiting for them to return to life. Commercial freezer manufacturers will be overjoyed, at least during this life.