When jet setting heiress, Doris Duke, died in 1993 she left a small trust for her last living relative, Walker Inman, Jr. Inman lived with her after being orphaned at the age of 13. He had previously inherited an inflation adjusted equivalent of $350 million from other relatives when he turned 21.

Inman died of a methadone overdose in 2010. He left his remaining fortune in trust for his now 16 year old twins. The twins and their mother are suing the trustees of the trusts trying to determine how much money is left while complaining that the trustees they were too generous in giving money to Inman who spent $90K per month. Meanwhile the mother is asking the trustees to buy a $29 million ranch and a $4.2 house, and reimburse her $17K for 4 days in Vegas. His fifth wife, and proverbial former topless dancer, has asked for $1.9 million. The trustee has vetoed those requests. The twins will receive their inheritance at 21.

Several points:

1. 21 is way too young to receive a principal distribution of any significance. I stagger distributions in my trusts with increasing amounts over time with the first distribution at 25 and the final distribution at the age of 40.

2. An anti-alcoholism, drugs, and gambling clause is also recommended to prevent heirs from harming themselves with their inheritance.

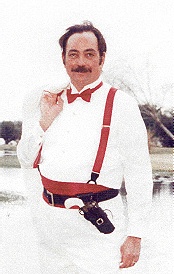

3. Supposedly nothing is sadder than the tears of a clown, but I think a middle aged man dying of a drug overdose is close. Sad meaning pitiful.