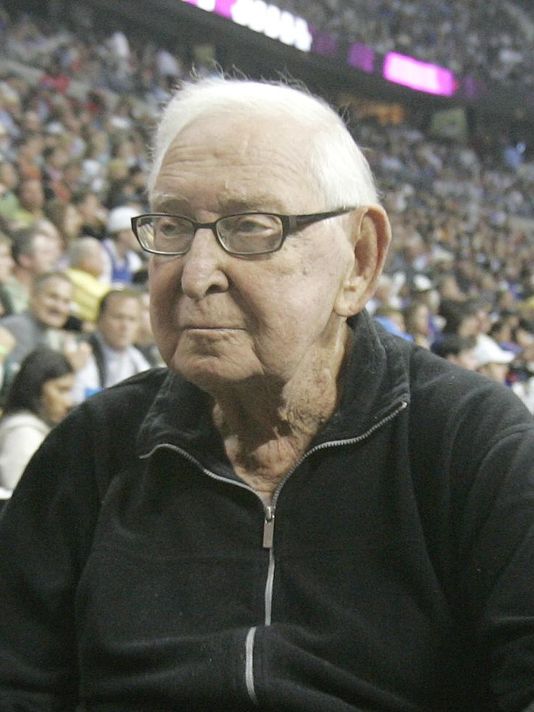

As I previously wrote, William Davidson was the owner of the Detroit Pistons, Detroit Shock, and the Tampa Bay Lightning. He was also the 62nd richest man in the U.S. at the time of his death with a reported net worth of $4.5 billion in 2008 (and perhaps $3 billion at the time of his death in early 2009). His estate recently settled a dispute with the IRS over the amount of transfer taxes owed for $388 million after the IRS claimed a $2.7 billion deficiency after his estate had previously paid $245 million in transfer taxes. His estate has now sued Deloitte and Touche for $500 million on the grounds that the estate planning advice was bad and that the firm had wanted to land Mr. Davidson as a client for marketing purposes. Allegedly, Deloitte had promised that “he would win if lived and would he would win if he died” with their strategies.

As I previously wrote, William Davidson was the owner of the Detroit Pistons, Detroit Shock, and the Tampa Bay Lightning. He was also the 62nd richest man in the U.S. at the time of his death with a reported net worth of $4.5 billion in 2008 (and perhaps $3 billion at the time of his death in early 2009). His estate recently settled a dispute with the IRS over the amount of transfer taxes owed for $388 million after the IRS claimed a $2.7 billion deficiency after his estate had previously paid $245 million in transfer taxes. His estate has now sued Deloitte and Touche for $500 million on the grounds that the estate planning advice was bad and that the firm had wanted to land Mr. Davidson as a client for marketing purposes. Allegedly, Deloitte had promised that “he would win if lived and would he would win if he died” with their strategies.

Several points:

1. I understand the frustration, but I do not see the damages (which are key for a lawsuit). The effective tax rate for deaths in 2009 was 45% which means that Mr. Davidson’s total tax bill conservatively could have been $1.35 billion. Instead, with tax planning he paid $583 million in taxes with only $133K in penalties. I do not see how his estate was harmed by the planning advice.

2. According to the figures, his estate declined in value by 1/3 in one year. The financial crisis was hard on everyone.

3. If he had died in 2010 like George Steinbrenner, his estate would not have owed any estate taxes because there was no estate tax that year (although there would have been a deficiency for his unpaid gift and generation skipping taxes).

4. I remain unconvinced that anyone truly “wins when they die.”