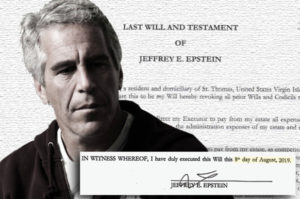

So my blog prognostication abilities continue to be abysmal. In addition to the coroner determining that Jeffrey Epstein hung himself, he actually prepared a will two days before he died.

Epstein’s will left everything to a trust he created the same day as his will. Of course, the trust beneficiaries and its terms are private. His will designates two long time employees as co-executors of his estate and provided that they would each receive $250K for serving in that capacity. Meanwhile, an attorney for one of the women suing Epstein claims that he was an evil genius for filing the estate in the U.S. Virgin Islands.

Several quick points:

1. Epstein’s estate is being probated in the US Virgin Islands because that is where he was considered a resident. Estates are probated in the decedent’s state of domicile.

2. The NY Post’s expert who said the will was filed in the Virgin Islands due to privacy reasons and the attorney suing Epstein on behalf of his alleged victims who thinks the US Virgin Islands filings are pure evil are fools and need to brush up on probate law.

3. It is interesting that the executors have agreed to fill that role for $250K. The commissions for executors are set by statute. Typically, they would receive a percentage of the estate which would be at least 1% or $5.7 million in this matter.

4. The reporting by the NY Post and the NYT has been error filled on this matter. I expect shoddy reporting from them on matters involving President Trump and from the Cincinnati Enquirer, but not from the NYT on a story like this.

Photo Credit: NY Post Composite

License: Fair Use/Education (from linked article)