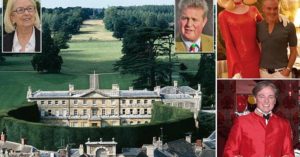

Finally, there is some estate planning news to write about. Gloria Cary was an American woman who was the second wife of the eccentric eighth Earl of Bathurst. When the Earl died in 2011, he left his home and surrounding real estate, valued at $17 million, to his son, and the rest of his estate to his widow.

Typically, his widow and son did not get along even though the couple had been married for more than 30 years. After the Earl’s death, the widow was forced to vacate the family home inherited by the son. She sued for permission to visit the home to view the family’s collection of heirlooms, but she was denied by her step-son.

A few quick observations:

1. At least the son inherited a significant amount upon the death of his father and was not disinherited entirely.

2. Inheriting an English estate is a double edged sword because the maintenance costs can be stratospheric.

3. If the Earl of Bathurst (“Barmy Bathurst”) wanted to ensure his son received some of his fortune, he should have created a trust to benefit his wife with the remainder going to his son. Although a trust might have been a step too far for an eccentric.

4. Of course, if the son wanted to inherit more than the house, he should have acquiesced to his step-mom’s request to occasionally visit and wander around the property.

Photo credit: compendium of pics from Daily Mail

License: Fair Use/Education (from linked article)