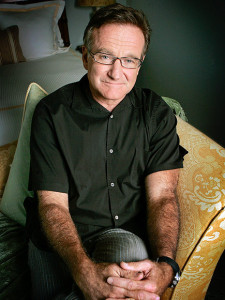

The widow of Robin Williams and his children from his prior marriages settled their dispute over his estate this week. His third wife was seeking some of his personal belongings, which he left to his children in his will, and funds to continue to reside in their home for the rest of her life. Williams had left her the home in trust, but apparently did not set aside a specific sum to provide for the upkeep of the house for her lifetime. The undisclosed settlement provides that she will have sufficient funds to live in the house the rest of her life, plus she will be able to keep their wedding gifts, a bike they purchased on their honeymoon, a watch, and the tuxedo he wore to their wedding. They also disputed the ownership of various photographs.

The widow of Robin Williams and his children from his prior marriages settled their dispute over his estate this week. His third wife was seeking some of his personal belongings, which he left to his children in his will, and funds to continue to reside in their home for the rest of her life. Williams had left her the home in trust, but apparently did not set aside a specific sum to provide for the upkeep of the house for her lifetime. The undisclosed settlement provides that she will have sufficient funds to live in the house the rest of her life, plus she will be able to keep their wedding gifts, a bike they purchased on their honeymoon, a watch, and the tuxedo he wore to their wedding. They also disputed the ownership of various photographs.

Three brief points:

1. This dispute was really about the funds to keep her in their Tiburon house. The rest of the items are inconsequential.

2. I am glad his children were able to allow his widow to have one watch and one bike from his watch and 50 bike collection.

3. In the era of digital photography, does anyone really fight over the ownership of pictures when they are readily reproduced?

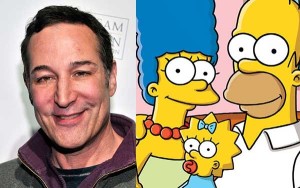

Sam Simon was renowned as the co-creator of “The Simpsons.” When he died earlier this year, he left an estate worth at least $100 million, most of which he left to charity. He left the care of his rescue dog, a Cane Corso (think a pit bull on steroids, dating from Roman times) to the dog’s trainer.

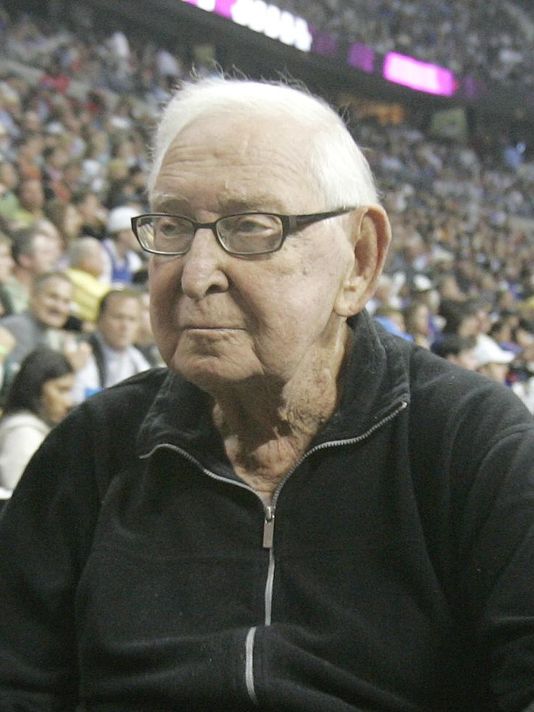

Sam Simon was renowned as the co-creator of “The Simpsons.” When he died earlier this year, he left an estate worth at least $100 million, most of which he left to charity. He left the care of his rescue dog, a Cane Corso (think a pit bull on steroids, dating from Roman times) to the dog’s trainer.  As I previously wrote, William Davidson was the owner of the Detroit Pistons, Detroit Shock, and the Tampa Bay Lightning. He was also the 62nd richest man in the U.S. at the time of his death with a reported net worth of $4.5 billion in 2008 (and perhaps $3 billion at the time of his death in early 2009). His estate recently settled a dispute with the IRS over the amount of transfer taxes owed for $388 million after the IRS claimed a $2.7 billion deficiency after his estate had previously paid $245 million in transfer taxes.

As I previously wrote, William Davidson was the owner of the Detroit Pistons, Detroit Shock, and the Tampa Bay Lightning. He was also the 62nd richest man in the U.S. at the time of his death with a reported net worth of $4.5 billion in 2008 (and perhaps $3 billion at the time of his death in early 2009). His estate recently settled a dispute with the IRS over the amount of transfer taxes owed for $388 million after the IRS claimed a $2.7 billion deficiency after his estate had previously paid $245 million in transfer taxes.  Meadow Williams is an actress of whom you have never heard and who appeared in movies you never saw. She was married to Gerald Kessler, founder of Natural Organics natural supplements company, for four years prior to his death earlier this year. He was 31 years older than her. In 2013, he changed his will to leave all of his $800 million estate to her while excluding his 2 children and 5 grandchildren.

Meadow Williams is an actress of whom you have never heard and who appeared in movies you never saw. She was married to Gerald Kessler, founder of Natural Organics natural supplements company, for four years prior to his death earlier this year. He was 31 years older than her. In 2013, he changed his will to leave all of his $800 million estate to her while excluding his 2 children and 5 grandchildren.  A Manhattan millionaire left $100K to a pet trust for her 32 cockatiels

A Manhattan millionaire left $100K to a pet trust for her 32 cockatiels