Not Misty’s Foal

- Tuesday, 16 October 2018 18:42

You Say Tomato, I Say Tomahto

- Thursday, 04 October 2018 10:39

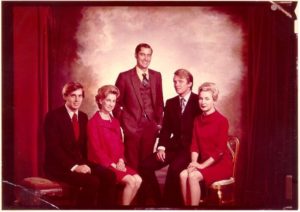

The New York Times just published 15,000 words about the estate and gift tax strategies President Trump’s father, Fred Trump, used to transfer his billion dollar real estate empire to his children more than 20 years ago. NYT reporters accessed public records and had others provide them confidential documents such as estate and gift tax returns. The point of the NYT piece is to disprove President Trump’s claim that he is a self-made man by claiming he received $413 million from his dad. They do not note that represents only 1/7 of his current net worth as reported today by Forbes.

A few points:

1. Even though the NYT used the terms “tax dodger,” “sham,” “dubious schemes,” and “improper,” to describe Fred Trump’s planning, the actual planning strategies he used were legitimate.

2. Fred Trump utilized valuation discounts and special trusts called GRATs to greatly reduce the gift and estate taxes owed on the transfer of his assets to his children.

3. Any impropriety on the transfers is due to the appraisal values for the real estate which seemed low in light of later sales.

4. Try as the NYT might to implicate President Trump in any impropriety, any wrong doing belongs to the person making gifts, i.e. Fred Trump, not the person receiving the gifts.

5. Am I the only one to notice that only confidential tax returns of Republicans are leaked to the press?

Photo Credit: Trump Campaign via New York Times

License: Fair Use/Education (from linked article)

This Happens Once In a Career

- Thursday, 20 September 2018 21:20

Elaine Chao, the U.S. Secretary of Transportation, used my conference room today while waiting for a meeting to start down the hall. She was in town to discuss transportation issues with Congressman Chabot and representatives from Uber, Red Bike, and the Chamber of Commerce among others. She and her staff were incredibly gracious.

COPY

- Thursday, 20 September 2018 21:12

The estate is supposed to turn Mr. Indiana’s dilapidated house into a museum to display his works. The estate is now embroiled in litigation over the withdrawn cash and whether Mr. Indiana was actually producing new art at the time of his death.

A few points:

1. Situations involving wealthy elderly individuals with no close family are always difficult because there is so much potential for financial exploitation.

2. Sometimes the caretaker is the best person to serve as attorney in fact if there are no relatives and the individual has outlived all of his friends.

3. Still, $600K of withdrawals for an individual living on an island off the coast of Maine with no place to spend the money seems excessive.

4. The last thing our country needs is another remotely situated vanity based museum dedicated to an artist of modest reknown.

5. AC/DC apparently copied Mr. Indiana’s playbook of recycling/copying prior work to earn great wealth.

Photo Credit: Johnsonville Sausage

License: Fair Use/Education (from linked article)

The Morning Line Again

- Monday, 10 September 2018 08:38

I subbed for Paul Daugherty’s The Morning Line blog in the Cincinnati Enquirer on Friday. I covered some moves by the Bengals, the UC-Miami game this weekend, and the Reds futility. I also commented on the shootings on Fountain Square on Thursday. I hope you enjoy it.

I subbed for Paul Daugherty’s The Morning Line blog in the Cincinnati Enquirer on Friday. I covered some moves by the Bengals, the UC-Miami game this weekend, and the Reds futility. I also commented on the shootings on Fountain Square on Thursday. I hope you enjoy it.

No Mayo, Please

- Wednesday, 29 August 2018 10:02

Alyssa Gilderhus was 18 years old when she suffered a ruptured aneurysm. She was given a 2% chance of survival when she arrived at the Mayo Clinic. Miraculously, she survived and was transferred to the Mayo’s rehab section. Her mother soon became disenchanted with her care and requested that various personnel not attend to her daughter while voicing her displeasure on Facebook posts in all caps. She eventually asked for a transfer to a different hospital.

The Mayo Clinic refused the transfer request alleging that Alyssa could not make decisions for herself. The hospital also sought guardianship of the patient. Frustrated, Alyssa’s family engaged in a cloak and dagger move with Alyssa escaping the hospital and fleeing Minnesota so she could not be returned to the hospital.

A South Dakota hospital saw Alyssa and prescribed medication and sent her home. Alyssa graduated from high school this year after being named Prom Queen.

One point, one plug, and one comment.

1. When she turned 18, Alyssa should have executed a health care power of attorney and a HIPAA Release so her mom could access her health care records and legally make medical decisions for her during her incapacity.

2. I always advise my clients to have their children execute those documents when they turn 18 and definitely before leaving for college. My fee is $150.

3. I would tend to follow the advice of doctors at the Mayo Clinic over those at a rural South Dakota hospital. But if a mother who posts on Facebook in all caps with exclamation points wants to follow different advice for her daughter’s care, she, not a social worker, should have the right to make that decision.

Photo Credit: Engebretson family

License: Fair Use/Education

Chain of Fools

- Tuesday, 21 August 2018 22:12

When Aretha Franklin died last week after a long battle with pancreatic cancer, she allegedly did not leave a will. She is survived by her four sons, one of whom has special needs, who will receive equal shares of her estate. Her niece asked to be appointed as representative of her $80 million estate. Aretha’s copyright attorney told reporters that when there is no will, “there will always end up being a fight.”

Some points of relevant interest:

1. No one wins a long battle with pancreatic cancer. See Jobs, Steve. Prepare a will.

2. When a woman dies without a will, there should not be much to dispute because there are no illegitimate children to contest heirship.

3. The niece’s fee for serving as personal rep. could be $1.6 million. One of the sons should have dibs on this role.

4. Surprisingly, Madonna did not ask to be appointed as personal representative.

Photo Credit: Jae C. Hong/AP

License: Fair Use/Education (from linked article)

Close a Chapter

- Monday, 20 August 2018 10:40

Janice and I dropped Jack at Ohio State on Saturday, closing the “married with children at home” chapter of our lives. He did not take the super hero lunch box.

Seether

- Thursday, 16 August 2018 13:30

In a story only tangentially related to estate planning, Victoria Salt died when she was 2 days old. Her father, George, visited her grave in Manchester, England semi-annually since 1988. On a recent visit, he learned that her grave was actually in a different part of the cemetery because the marker had been in the wrong place. He said he was gobsmacked by this revelation.

Three points of no significance:

1. This is sad for Mr. Salt who showed incredible love for his daughter.

2. Americans should adopt gobsmacked as part of the vernacular.

3. The grave surrounded by squirrels is Veruca Salt’s.

Photo Credit: Google Earth images

License: Fair Use/Education (in linked article)

Piece of Britney (Part 2)

- Friday, 10 August 2018 11:44

Since her breakdown in 2007 and early 2008, Britney Spears’ finances have been controlled by her co-conservators – her father, Jamie Spears, and attorney, Andrew Wallett. The conservatorship was to assist Britney with managing her financial affairs after she shaved her head, performed poorly at the MTV Video Awards, and locked herself in her bathroom with her young son for 24 hours.

Recent court filings show that Britney earned $56 million last year and spent $385K. Predictably, her ex-husband, Kevin Federline, wants to triple the $20K/month child support he receives from Britney. The one time back up dancer has six kids – two with Britney, two with his first wife, and two with his current wife – but only earns $35K/year. Britney and her co-conservators oppose the increase request. The child support will end in any case when their youngest son turns 18 in 2024.

Several points:

1. If the conservatorship has limited Britney’s spending to $385K, it is clearly working so why end it?

2. $240K should be more than sufficient for K-Fed’s two sons with Britney. He likely needs the extra cash to support his other 4 children.

3. Some of Britney’s favorite stores per the filings are Target, TJ Maxx, Old Navy, Ralph’s, and McDonalds. You can take the girl out of Louisiana but apparently you cannot take Louisiana out of the girl.

Photo Credit: Reuters/Mario Anzuoni – RC1AEDAB9420

License: Fair Use/Education (from linked article)

iPhoneJD

- Wednesday, 08 August 2018 21:11

Jeff Richardson is a New Orleans attorney who writes a blog named iPhoneJD. He posts about matters concerning iPhones (and other iOS devices) and the practice of law. He asked me to write a post about the apps I prefer. Because I have too much free time, I obliged.

His Old School

- Thursday, 02 August 2018 09:20

Don’t Go Crazy

- Tuesday, 31 July 2018 09:48

(Not) Gentle On His Mind

- Tuesday, 31 July 2018 09:42

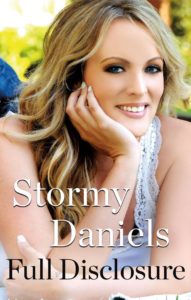

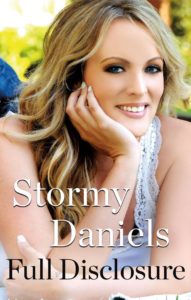

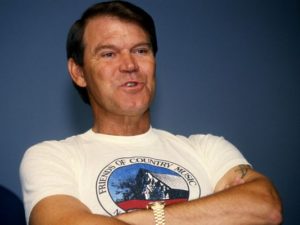

After Glen Campbell died last year of Alzheimer’s disease, his fourth wife of 35 years presented a will to the probate court which excluded his 3 children from his second marriage. The will, which was executed in 2006, did provide for his wife and all of his children from his first, third, and fourth marriages. Naturally, his excluded children are contesting his mental capacity to execute the will.

Several brief points:

1. Campbell’s disinherited children will have to prove that Alzheimer’s caused him to forget that they were his children, or to harbor animus to them.

2. Their case will be difficult to prove because the will was executed five years prior to him telling the public that he was suffering from Alzheimer’s.

3. Their case will be doubly difficult because Campbell’s 2001 will also excluded them.

4. As a general rule, if you want to inherit from your father, do not sue him while he is alive (as they were alleged to have done over publishing rights).

Photo Credit: Calli Shell for The Tennessean (in linked article)

License: Fair Use/Education

Will, Trust, and Net Worth Unknown

- Saturday, 14 July 2018 10:03

She Loved the Dough

- Thursday, 05 July 2018 15:24

Heather Mack is the “Body in a Suitcase” murderer who is serving time in a “notorious” Indonesian prison for killing her mother in 2015 in Bali and stuffing her body in a suitcase. The motive was money. A taxi driver who saw blood dripping from the suitcase notified authorities. Mack was sentenced to 10 years in prison. While in prison, she gave birth to a daughter, Stella, with whom she was pregnant at the time of her conviction.

The trustee of her mother’s trust refused to pay Mack her inheritance due to Illinois’ slayer statute. The trustee and Mack finally agreed that Mack’s daughter, Stella, will receive the $1.6 million instead. Despite her incarceration, Mack has been seen lounging around prison with her boyfriend while also posting photos on social media of herself in restaurants with her boyfriend.

Not much new ground to cover.

1. Slayer statutes prevent a murderer from financially benefitting from her crime.

2. My definition of “notorious” differs from that of others when prison involves having a boyfriend and going out to restaurants with him.

3. 10 years for murdering her mother? The Menendez brothers wish they had committed their crimes in Bali.

Happy Fourth of July

- Wednesday, 04 July 2018 15:17

Finally settled in after returning from a week in Portugal. Post to follow shortly.

Finally settled in after returning from a week in Portugal. Post to follow shortly.

Suspicious Minds

- Thursday, 21 June 2018 17:35

It has been a slow month for celebrity estate planning news. Lisa Marie Presley is embroiled in a lawsuit with her financial manager claiming he mismanaged her $100 million trust and left her with $14,000. She alleges that the manager sold 85% of her ownership in Elvis Presley Enterprises in 2005 for $100 million but invested most of the proceeds in the company which owned American Idol which filed for bankruptcy in 2016. She is also in the midst of a divorce from her fourth husband who is seeking $263,000 in annual alimony payments. She claims to owe $10 million in back taxes and $6 million in other debts.

Lots to digest.

1. The manager has countersued for $800K for unpaid investment fees. He alleges that Lisa Marie has a spending problem.

2. Allegedly, $20 million of the $100 million sales proceeds were used to pay off debts she had accumulated at the time.

3. Lisa Marie’s mother was concerned enough about her ability as a high school dropout to manage the inheritance that she was able to delay the distribution from Elvis’ trust until she turned 30.

4. Call it a hunch, but I suspect that Lisa Marie’s drug abuse, uncontrolled spending, and four marriages have as much to do with the financial straits as poor fiscal management.

Photo credit: Unknown

License: Fair Use/Education (from linked article)

Long Blue Line

- Sunday, 03 June 2018 20:16

Jack graduated from St. Xavier on Thursday. He will attend Ohio State’s Fisher School of Business.

Mellon’s Folly and the Infinite Sadness

- Friday, 18 May 2018 08:56

Matthew Mellon was descended from the famous banking family. He died last month at the age of 54 after ingesting the hallucinogenic ayahuasca before starting rehab. At one time he had a $100K/month oxycontin habit.

When Mellon turned 21, he received a $25 million allowance from a family trust, one of 14 trusts established for him. He recently became a billionaire by investing in cryptocurrency. TMZ is reporting that his estate is now petitioning the probate court to authorize the sale of the cryptocurrency.

So many intersecting points in current events:

1. Someone should never give their child $25 million at the age of 21. Trusts can be created to defer an inheritance for as long as necessary.

2. In probate, assets can usually not be sold or transferred until the entire list of assets has been compiled which can take many months. With the decline in value of crytopcurrency, the estate wants to sell it before people realize its true value is likely zero.

3. Mellon might be the wealthiest victim of our tragic opioid crisis.

4. Following the lynching last month of a Canadian who moved to a Peruvian jungle to seek clarity through ayahuasca but somehow killed a shaman, Mellon is the second person whose newsworthy death can be attributed to it.

5. Ayahuasca is described as a sludgelike hallucinogenic potion used by indigenous shamans in spiritual exercises. I will take my drink inspired spiritual experiences through a nice fruit forward cabernet.

Photo Credit: Forbes/Ethan Pines

License: Fair Use/Education (linked article)