Sam Simon was renowned as the co-creator of “The Simpsons.” When he died earlier this year, he left an estate worth at least $100 million, most of which he left to charity. He left the care of his rescue dog, a Cane Corso (think a pit bull on steroids, dating from Roman times) to the dog’s trainer. Alas, he did not leave any funds to the trainer for the care of the dog which requires twice a week acupuncture at $3,600 per month, gluten free regionally sourced food for $185 month, and $150 grooming every three weeks. The trainer also requested his $7,500 monthly fee to work with the dog to keep it from “changing your life in an instant (i.e. mauling)” even though the trainer now owned the dog. The trainer is upset that the trustee will not provide him the funds he has requested to care for the dog.

Sam Simon was renowned as the co-creator of “The Simpsons.” When he died earlier this year, he left an estate worth at least $100 million, most of which he left to charity. He left the care of his rescue dog, a Cane Corso (think a pit bull on steroids, dating from Roman times) to the dog’s trainer. Alas, he did not leave any funds to the trainer for the care of the dog which requires twice a week acupuncture at $3,600 per month, gluten free regionally sourced food for $185 month, and $150 grooming every three weeks. The trainer also requested his $7,500 monthly fee to work with the dog to keep it from “changing your life in an instant (i.e. mauling)” even though the trainer now owned the dog. The trainer is upset that the trustee will not provide him the funds he has requested to care for the dog.

Several points:

1. Trusts to provide for the care of pets after the death of an owner are permissible under Ohio law.

2. If Mr. Simon’s trust did not specifically provide for the care of the dog after his death, the Trustee is not permitted to distribute funds to the new owner of the dog.

3. When leaving someone one’s pet, one should also leave a sum of money to care for the animal. I always address this issue with my clients, lest they impose a financial burden on their friends.

4. Mr. Simon could have made a huge difference in many human lives with the $140K he was spending annually on a dog prone to attacking anyone who walked onto his property, although attacking Howard Stern is understandable.

5. Gluten free, regionally sourced food for dogs? L.A. deserves our scorn and mockery.

Dad’s Weekend.

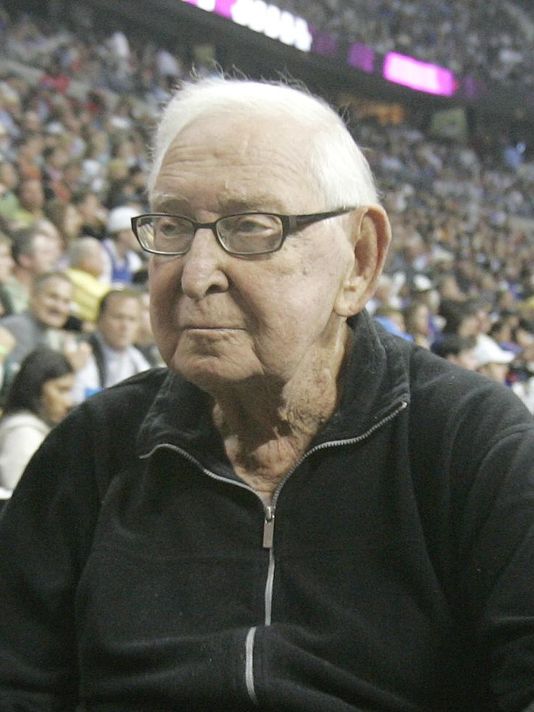

Dad’s Weekend. As I previously wrote, William Davidson was the owner of the Detroit Pistons, Detroit Shock, and the Tampa Bay Lightning. He was also the 62nd richest man in the U.S. at the time of his death with a reported net worth of $4.5 billion in 2008 (and perhaps $3 billion at the time of his death in early 2009). His estate recently settled a dispute with the IRS over the amount of transfer taxes owed for $388 million after the IRS claimed a $2.7 billion deficiency after his estate had previously paid $245 million in transfer taxes.

As I previously wrote, William Davidson was the owner of the Detroit Pistons, Detroit Shock, and the Tampa Bay Lightning. He was also the 62nd richest man in the U.S. at the time of his death with a reported net worth of $4.5 billion in 2008 (and perhaps $3 billion at the time of his death in early 2009). His estate recently settled a dispute with the IRS over the amount of transfer taxes owed for $388 million after the IRS claimed a $2.7 billion deficiency after his estate had previously paid $245 million in transfer taxes.

Meadow Williams is an actress of whom you have never heard and who appeared in movies you never saw. She was married to Gerald Kessler, founder of Natural Organics natural supplements company, for four years prior to his death earlier this year. He was 31 years older than her. In 2013, he changed his will to leave all of his $800 million estate to her while excluding his 2 children and 5 grandchildren.

Meadow Williams is an actress of whom you have never heard and who appeared in movies you never saw. She was married to Gerald Kessler, founder of Natural Organics natural supplements company, for four years prior to his death earlier this year. He was 31 years older than her. In 2013, he changed his will to leave all of his $800 million estate to her while excluding his 2 children and 5 grandchildren.  In a slow week in celebrity estate news, the only newsworthy item is an

In a slow week in celebrity estate news, the only newsworthy item is an  A Manhattan millionaire left $100K to a pet trust for her 32 cockatiels

A Manhattan millionaire left $100K to a pet trust for her 32 cockatiels Paul Daugherty of the Cincinnati Enquirer allowed me to write his

Paul Daugherty of the Cincinnati Enquirer allowed me to write his  A Columbus widow is suing L Brands

A Columbus widow is suing L Brands